2 Which of the Following Best Describes an Accrual Adjustment

Accounts receivable is usually increased when accruing revenues. Which of the following best describes the accrual basis of accounting.

Acg2021 Ch 4 Concept Overview Videos Flashcards Quizlet

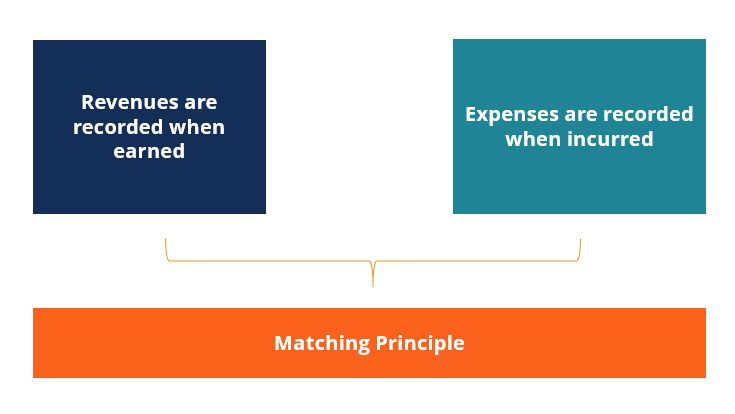

The matching concept leads accountants to select the recognition alternative that produces the lowest amount of net income.

. To expens e ov er the periods. Debit to an expense and a credit to an asset. An increase in one asset and a decrease in another asset.

Under a royalty agreement with another company Wand Co. Which of the following best describes an accrual adjustment. DIt does not require adjusting entries to properly match revenues and expenses.

Requires equilibrium of resources and the claims on those resources. The adjustment causes an increase in an asset account and an increase in a revenue account. None of the above.

Which of the following best describes when an accrual adjustment is required. 1 Occurs before the expense recognition 2 Occurs by definition the same time as the expense recognition 3 None of the above 4 Is irrelevant since the cash flow means nothing in the accrual model 5 Occurs after the expense recognition Answer. One major difference between deferral and accrual adjustments is that deferral adjustments.

BIt records transactions only when cash is received or paid. Adjusting entries where cash flow and revenue or expense recognition are simultaneous d. Two of the steps in the accounting cycle are adjusting the accounts and closing the accounts.

2 It records a transaction in a way that delays or defers the recognition of an expense or revenue. Recored an adjusting entry. In the period paid.

In the period incurred. May 02 2020View moreView Less. Determine what the current account balance is.

The correct answer is. Assuming that adjusting entries have not been made during the year the amount of accrued interest payable to be reported on the December 31 2016. Adjustments involve increasing both an expense account and a liability account.

A company sometimes recognizes a revenue. W hich of. A An accrual adjustment that increases an asset will include an increase in an expense.

Adjusting entries are either accruals or deferrals. They refer to revenues that are earned in a period but have not been received and are unrecorded. All of the following embraced the national view of federalism except a.

An example of an account that could be included in an accrual adjustment for revenue is. Which of the following statements best describes the balance in a revenue account at the beginning of an accounting period. W hen prep ari ng the fi.

Adjusting entries where revenue or expense recognition precedes cash flow c. Expressed another way accrual adjusting entries are the means for including transactions that occurred. Will pay royalties for the assignment of a patent for three years.

Which of the following best describes when an accrual adjustment is required. Credit to a revenue and a debit to an expense. If the year-end adjustment is properly recorded on December 31 Year 1 what will be the effect of this accrual on net income and cash flows from operating activities reported for Year 1.

Accrual adjusting entries or simply accruals are one of three types of adjusting entries which are prepared at the end of an accounting period so that a companys financial statements will comply with the accrual method of accounting. Cash-basis accounting often fails to match expenses with revenues. Which of the following best describes when an accrual adjustment is requiredAn expense has not been incurred but cash has been paidAn expense has been incurred but not yet paid in cashAn expense has not been incurred nor has it been paid in cashAn expense has been incurred and paid in cash.

A- Sparta was a society based on exploration and expansion and its government was also based on this concept. An expense has been incurred but not yet paid in cash. They refer to revenues that are earned in a period but have not been received and are unrecorded.

CIt records revenue as it is earned and matches expenses against the revenue they generate. Insu rance expens e. It is created when a revenue or expense has.

In a deferral the cash flow. At the end of the year accrual adjustments could include a. Adjustments involve increasing both an expense account and a liability account.

Requires at least one entry to record a transaction. The royalties paid should be reported as expense. During wh ich bene f i ts are.

46Phipps Company borrowed 25000 cash on October 1 2016 and signed a nine-month 8 interest-bearing note payable with interest payable at maturity. Which of the following best defines an accrual. Adjusting entries where cash flow precedes revenue or expense recognition b.

Determine what the current account balance should be. 500 of supplies were purchased at the beginning of the period. An adjusting journal entry is made at the ______ beginningmiddleend of an accounting period.

B A deferral adjustment that decreases an asset will include an increase in an expense. Accounts receivable is usually increased when accruing revenues. Debit to cash and a credit to Common Stock.

Definition of Accrual Adjusting Entries. The adjustment causes an increase in an asset account and an increase in a revenue account. AIt records only transactions involving increases or decreases of cash.

Asked Sep 15 2019 in Business by Tosfera. Asked Sep 8 2019 in Business by SunVisitor. Which best describes how Spartas culture influenced the city-states government.

ACC201 PCQ 2 questions the type of fraud committed company managers who make false and misleading entries in the books so as to make the financial results of. Debit to an expense and a credit to a liability. At the date the royalty agreement began.

B- Sparta was a society based on. C An accrual adjustment that increases an expense will include a decrease in a liability. Changes in inventories due to acquisition of another company are not included as part of the inventory adjustment to accrual-basis income.

Deriv ed f rom own ers hip of the.

Acg2021 Ch 4 Concept Overview Videos Flashcards Quizlet

Solved Which Of The Following Best Describes When An Accrual Chegg Com

Adjusting Entries Guide To Making Adjusting Journal Entries Examples

Comments

Post a Comment